The Harshad Mehta scam, also known as the securities scam of 1992, was one of the most infamous financial frauds in India’s history. This scandal shook the nation’s confidence in the stock market and exposed the loopholes in the regulatory system. Let’s delve into the details of this dark chapter in Indian financial history.

The Rise of Harshad Mehta

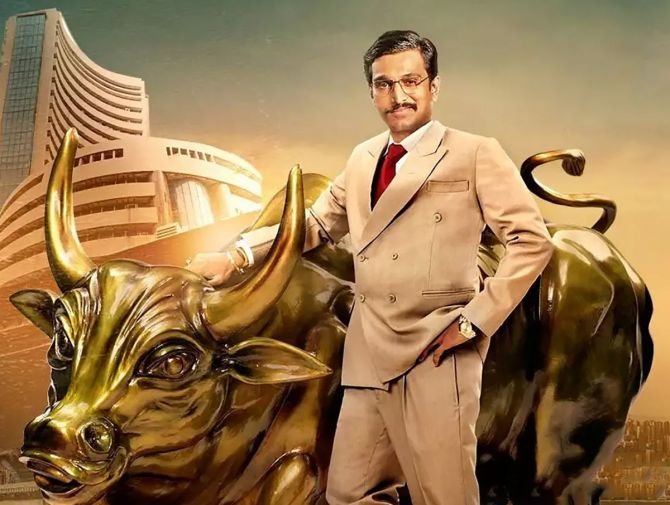

Harshad Mehta, a stockbroker from Mumbai, rose to prominence in the late 1980s and early 1990s. He was known for his flamboyant lifestyle and was often referred to as the “Big Bull” due to his bullish approach to the stock market. Mehta’s rise to fame was fueled by his ability to manipulate the stock prices of certain companies.

Mehta exploited a loophole in the banking system known as the “Ready Forward” (RF) deal. He used this mechanism to borrow money from banks against government securities and then artificially inflate the prices of certain stocks. This created a frenzy in the market, with investors rushing to buy these stocks, further driving up their prices.

The Scam Unveiled

The scam came to light in April 1992 when journalist Sucheta Dalal published an article exposing Mehta’s fraudulent activities. The article revealed how Mehta had manipulated the stock prices of various companies, including the flagship State Bank of India (SBI) shares.

As news of the scam broke, panic spread across the stock market. Investors rushed to sell their shares, causing a massive crash in stock prices. The Sensex, India’s benchmark stock index, plummeted from its peak of around 4,500 points to below 2,000 points within a matter of weeks.

The Aftermath

The Harshad Mehta scam had far-reaching consequences for the Indian economy and the stock market. The scam exposed the loopholes in the banking system and the lack of proper regulation and oversight. It led to a loss of investor confidence and a decline in foreign investments.

The government and regulatory bodies took several measures to restore faith in the stock market. The Securities and Exchange Board of India (SEBI) was established in 1992 to regulate and supervise the securities market. The government also introduced stricter regulations and increased transparency in the banking system.

Harshad Mehta and several others involved in the scam were arrested and faced criminal charges. Mehta was convicted in 1999 for his role in the scam and was sentenced to five years in prison. However, he passed away in 2001 before serving his full sentence.

Lessons Learned

The Harshad Mehta scam served as a wake-up call for the Indian financial system. It highlighted the need for stronger regulations, improved transparency, and stricter oversight. The incident led to significant reforms in the banking and stock market sectors.

The scam also emphasized the importance of investor education and awareness. It showed that blind faith in the market and unscrupulous practices could have devastating consequences. Investors learned the importance of conducting thorough research and due diligence before making investment decisions.

Conclusion

The Harshad Mehta scam remains a dark chapter in Indian financial history. It exposed the vulnerabilities of the banking and regulatory systems and led to significant reforms. While the scars of the scam are still felt, the incident served as a catalyst for change and paved the way for a more transparent and regulated financial market in India.

As investors and regulators continue to learn from the past, it is crucial to remain vigilant and ensure that such scams are not repeated. The Harshad Mehta scam serves as a reminder of the importance of integrity, transparency, and ethical practices in the financial world.